With volatile weather and growing rental markets, renters insurance is common throughout Texas — especially in larger metros.

How much are people paying for Renters Insurance in Texas?

Below are recent quotes from renters across Texas, including those in Austin, White Settlement, and Haslet. They reflect real premiums from major carriers.

| Quote Date | City | Monthly Premium | Property Type | Age Group |

|---|---|---|---|---|

| Jan. 31, 2026 | Austin, Texas | $30 | Apartment | 25–34 |

| Jan. 31, 2026 | Austin, Texas | $8 | Apartment | 25–34 |

| Jan. 31, 2026 | White Settlement, Texas | $11 | Apartment | 45–54 |

| Jan. 31, 2026 | White Settlement, Texas | $11 | Apartment | 45–54 |

| Jan. 31, 2026 | Haslet, Texas | $34 | Apartment | 25–34 |

* Selected, anonymized quotes from past submissions. Last updated: Jan. 31, 2026.

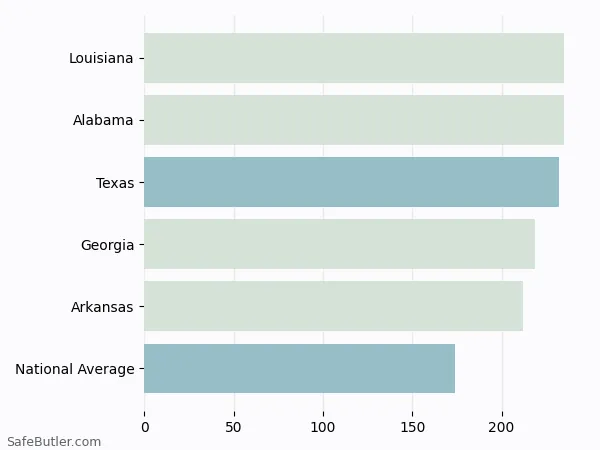

Renters insurance is one of the most affordable insurance in your daily life but can protect you financially from many risks. Texas tenants pay higher than the national average. The chart below compares four states with close premiums and the national average.

If you want to know how much it costs for your rental home, hit the big button below to get free quotes.

Compare your options now — it’s free

Why do YOU need Renters Insurance?

Although renters insurance is not required by law in Texas, apartment complexes and landlords often need tenants to purchase Renters Insurance before signing the lease agreement. Because the landlord's insurance only covers the damage to the actual dwelling, your renters insurance will protect your belongings inside the apartment in case of fire, theft, or injury.

What factors impact the Renters Insurance premium?

- The amount of coverage you chose

- The value of your personal property and whether your policy covers ACV or replacement costs

- The amount of your deductible

- The amount of liability coverage you choose

- The location of your rental home

Are the crime rates exceptionally high in your neighborhood? Rates may be higher as a result. Is the area prone to higher risks for wind or hurricane damage? These factors matter as well. - Discounts

You may be eligible for discounts if you have purchased other insurance policies with the provider or bundled your insurance. There are also discounts available for renters with added security features- such as deadbolt locks, security systems, smoke detectors, etc.

What are the Texas renters insurance discounts?

Most carriers provide various discounts for renters insurance, just like auto insurance. Here are some most common deals.

| Discount | Description |

|---|---|

| Multi-Policy | If you purchase both renters and auto insurance from the same company, you may qualify for a discount for the auto insurance. |

| Secure Home | Secure home If you have extinguishers or burglar alarm devices or are in a gated community, you may qualify for the secured home discount. It averages about 5% from quite a few carriers. |

| Claim-free | Just like auto insurance is lower for accident-free drivers, renters insurance is also cheaper for claim-free tenants. If you have never reported any claims, you will qualify for claim-free discounts from several carriers. |

| Age | Usually, for renters insurance, older people pay less than younger people for a similar property. If you're a college student trying to find a renters policy for your apartment near school, you will pay more. |

| Good Credit | A customer with a credit score higher than 700 can often get a better rate than those who don’t. |

| Pay-in-full | If the carrier supports monthly and yearly payments, paying in full will usually give you a discount. In other words, if you choose to pay monthly, you should pay attention to the extra fee your carrier charges. |

| Paperless | A few providers have paperless discounts if you opt-in. But more modern insurance companies will give you a competitive offer directly with more digitalized systems. |

What are the risks to consider in Texas?

Texas tenants face the risks of natural hazards such as fire, floods, and hurricane. However, most renters insurance policies do not cover damages to your personal property caused by a flood or an earthquake. Therefore, it is also a good idea to check with your insurance agent and learn more about what policies cover these specific disasters.

Last but not least, thanks to the increased risk of the exposure of personal information on the Internet in today's digital world, it is also essential to check if your renter's insurance provides identity theft protection.

Looking for the best renters insurance in Texas?

Click here to get started. You can compare hundreds of Renters insurance companies at once to get free, no-obligation quotes in just 60 seconds.

Find the best renters insurance in Texas

Compare the top insurance brands at once for free

Renters Insurance Rates for Cities in Texas

We compiled data about Renters Insurance rates for every city in Texas. A word of caution, as you explore the list below, there is no doubt you will find a wide price range.

- Abilene

- Addison

- Alamo

- Alamo Heights

- Aldine

- Alice

- Allen

- Alvin

- Amarillo

- Anderson Mill

- Andrews

- Angleton

- Aransas Pass

- Arlington

- Atascocita

- Athens

- Austin

- Azle

- Bacliff

- Balch Springs

- Bay City

- Baytown

- Beaumont

- Bedford

- Beeville

- Bellaire

- Bellmead

- Belton

- Benbrook

- Big Spring

- Boerne

- Bonham

- Borger

- Brenham

- Bridge City

- Brownfield

- Brownsville

- Brownwood

- Brushy Creek

- Bryan

- Burkburnett

- Burleson

- Canyon

- Canyon Lake

- Carrollton

- Carthage

- Cedar Hill

- Cedar Park

- Channelview

- Childress

- Cinco Ranch

- Cleburne

- Cleveland

- Cloverleaf

- Clute

- College Station

- Colleyville

- Commerce

- Conroe

- Converse

- Coppell

- Copperas Cove

- Corinth

- Corpus Christi

- Corsicana

- Crockett

- Crowley

- Crystal City

- Cuero

- Dalhart

- Dallas

- DeSoto

- Deer Park

- Del Rio

- Denison

- Denton

- Dickinson

- Donna

- Dumas

- Duncanville

- Eagle Mountain

- Eagle Pass

- Edinburg

- Eidson Road

- El Campo

- El Paso

- Ennis

- Euless

- Fabens

- Farmers Branch

- Flower Mound

- Forest Hill

- Fort Bliss

- Fort Hood

- Fort Stockton

- Fort Worth

- Fredericksburg

- Freeport

- Fresno

- Friendswood

- Frisco

- Gainesville

- Galena Park

- Galveston

- Garland

- Gatesville

- Georgetown

- Gladewater

- Glenn Heights

- Gonzales

- Graham

- Grand Prairie

- Grapevine

- Greatwood

- Greenville

- Groves

- Haltom City

- Harker Heights

- Harlingen

- Henderson

- Hereford

- Hewitt

- Hidalgo

- Highland Park

- Highland Village

- Highlands

- Hillsboro

- Hitchcock

- Homestead Meadows South

- Hondo

- Houston

- Humble

- Huntsville

- Hurst

- Ingleside

- Iowa Park

- Irving

- Jacinto City

- Jacksonville

- Jasper

- Jersey Village

- Jollyville

- Katy

- Kaufman

- Keller

- Kerrville

- Kilgore

- Killeen

- Kingsville

- Kirby

- La Feria

- La Homa

- La Marque

- La Porte

- Lackland AFB

- Lake Dallas

- Lake Jackson

- Lakeway

- Lamesa

- Lampasas

- Lancaster

- Laredo

- League City

- Leander

- Leon Valley

- Levelland

- Lewisville

- Liberty

- Littlefield

- Live Oak

- Lockhart

- Longview

- Lubbock

- Lufkin

- Lumberton

- Mansfield

- Marlin

- Marshall

- McAllen

- McKinney

- Mercedes

- Mesquite

- Mexia

- Midland

- Midlothian

- Mineral Wells

- Mission

- Mission Bend

- Missouri City

- Monahans

- Mount Pleasant

- Nacogdoches

- Navasota

- Nederland

- New Braunfels

- New Territory

- North Richland Hills

- Odessa

- Orange

- Palestine

- Palmview South

- Pampa

- Paris

- Pasadena

- Pearland

- Pearsall

- Pecan Grove

- Pecos

- Perryton

- Pflugerville

- Pharr

- Plainview

- Plano

- Pleasanton

- Port Arthur

- Port Lavaca

- Port Neches

- Portland

- Raymondville

- Rendon

- Richardson

- Richland Hills

- Richmond

- Rio Grande City

- River Oaks

- Robinson

- Robstown

- Rockport

- Rockwall

- Roma

- Rosenberg

- Round Rock

- Rowlett

- Sachse

- Saginaw

- San Angelo

- San Antonio

- San Benito

- San Elizario

- San Juan

- San Marcos

- Santa Fe

- Schertz

- Seabrook

- Seagoville

- Seguin

- Sherman

- Silsbee

- Slaton

- Snyder

- Socorro

- South Houston

- Southlake

- Spring

- Stafford

- Stephenville

- Sugar Land

- Sulphur Springs

- Sweetwater

- Taylor

- Temple

- Terrell

- Texarkana

- Texas City

- The Colony

- The Woodlands

- Tomball

- Trophy Club

- Tyler

- Universal City

- University Park

- Uvalde

- Vernon

- Victoria

- Vidor

- Waco

- Watauga

- Waxahachie

- Weatherford

- Webster

- Wells Branch

- Weslaco

- West Livingston

- West Odessa

- West University Place

- Wharton

- White Settlement

- Wichita Falls

- Windemere

- Woodway

- Wylie

References

Find your perfect insurance policy

Compare the top insurance brands at once for free

Disclaimer

Our articles are informational and should not be considered legal or financial advice. Our

articles are not written or reviewed by insurance agents. Consult your policies with your agent or a

professional for details regarding terms, conditions, coverage, exclusions, products, services, and programs.

SafeButler Inc. strives to ensure that the information on this site is up to date, but we will not be held

liable for any delays, inaccuracies, errors, or omissions. This site and all materials contained on it are

distributed and provided "as is" and "as available" for use. SafeButler.com makes no representations or

warranties of any kind, express or implied, as to the operation of this site or to the information, content,

materials, or products included on this site. You expressly agree that your use of this site is at your sole

risk.