Renter’s insurance is a wise choice to protect your belongings and provide liability coverage. It is increasingly required by landlords before signing the lease agreement. The landlord's own insurance usually only covers the damage to the actual dwelling, while your renter’s insurance is a good supplement to protect your personal property inside the apartment in the event of fire, theft or damage.

How much is Renters Insurance in Palo Alto?

Did you know that some renters in Palo Alto pay as little as $5 a month on renters insurance? We know because we referred them. Rent in Palo Alto can cost you an arm and a leg. Having to purchase renters insurance on top of that? That can easily set you back another arm.

Unfortunately, we can't control the price of insurance. But we can help you find the best deal. We believe that, when it comes to buying renters insurance, you shouldn't have to sift through a sea of information just to find something you can afford. That's why we've done the math and identified the providers with the cheapest average premiums in Palo Alto--so that you can focus on choosing the policy that works best for you.

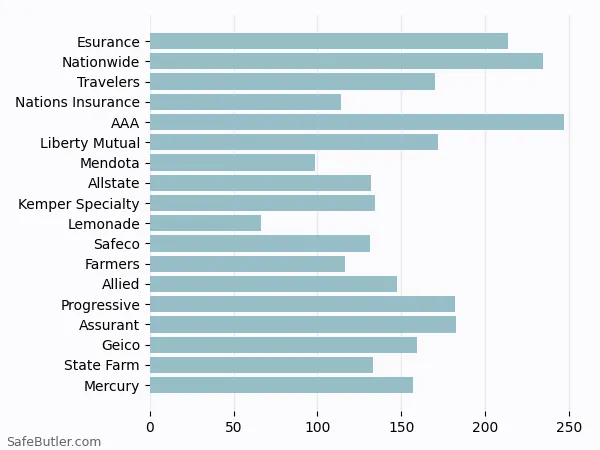

On average, Lemonade, Mendota, and Nations Insurance save renters the most money on their renters insurance in Palo Alto. By contrast, AAA has the highest average premium in Palo Alto.

But when it comes to purchasing renters insurance for yourself, why guess? Let us do the work for you. Try our free comparison tool to find out how much you could save on renters insurance in Palo Alto today!

What factors determine renters insurance premium?

The department of insurance has regulations in place regarding what factors can be used to determine your insurance premiums. In most cases, your location, age, and the amount of coverage you are seeking are the most significant factors for your renter’s insurance premium. In some states, your credit score is also taken into account and is an important factor.

- The amount of coverage you chose

- The value of your personal property and whether your policy covers ACV or replacement costs

- The amount of your deductible

- The amount of liability coverage you choose

- The location of your rental home

Are the crime rates exceptionally high in your neighborhood? Rates may be higher as a result. Is the area prone to higher risks for wind or hurricane damage? These factors matter as well. - Discounts

You may be eligible for discounts if you have purchased other insurance policies with the provider or bundled your insurance. There are also discounts available for renters with added security features- such as deadbolt locks, security systems, smoke detectors, etc.

Common renters insurance discounts

Most carriers provide various discounts for renters insurance, much like auto insurance. Below, you’ll find the most common discounts. Click here to start a free and personalized insurance quote to compare all the discounts.

| Discount | Description |

|---|---|

| Multi-Policy | If you purchase both renters and auto insurance from the same company, you may qualify a discount for the auto insurance. |

| Secure Home | If you have extinguishers, burglar alarm devices, or you are in a gated community, you may qualify for the secured home discount. This averages to a discount of about 5% for most carriers. |

| Claim-free | Just like auto insurance is lower for accident-free drivers, renter’s insurance is also cheaper for claim free tenants. If you have never reported any claims before, you will qualify for the claim-free discounts from quite a few carriers. |

| Age | Usually, for renters insurance, older people pay less than younger people for a similar property. So, if you’re a college student and trying to find a renter’s policy for your apartment near school, you are likely to pay more. |

| Good Credit | A customer with a credit score higher than 700 can often get a better rate than those with lower credit scores. |

| Pay-in-full | If the carrier supports both monthly and yearly payment, paying in full each year will likely give you a discount. In other words, if you choose to pay monthly, you should pay attention to the extra fee charged by your carrier. |

| Paperless | A few carriers even provide paperless discounts. This discount is not as common with newer carriers, so it may not be available with your policy. |

What are other risks to consider in Palo Alto?

Unfortunately, most renter’s insurance policies do not cover damages to your personal property caused by a flood or an earthquake. Palo Alto tenants do face the risks of natural hazards such as fire, storms, and floods . Therefore, it is also a good idea to check with your insurance agent and learn more about what policies are available that cover these specific disasters.

Last but not least, thanks to the increased risk of the exposure of personal information on the Internet in today’s digital world, it is also important to check if your renter’s insurance provides identity theft protection.

Curious about Renters insurance in neighboring cities?

- Stanford

- Menlo Park

- Los Altos Hills

- Mountain View

- Redwood City

- Sunnyvale

- Belmont

- Cupertino

- Foster City

- Fremont

- Santa Clara

Learn more about California renters insurance

If you are wondering how much the premium costs, what discounts are available in California, click here to learn more about California renters insurance.

References

Find your perfect insurance policy

Compare the top insurance brands at once for free

Disclaimer

Our articles are intended for informational purposes and should not be considered legal or financial advice. Our

articles are not written or reviewed by insurance agents. Consult your policies with your agent or a

professional for details regarding terms, conditions, coverage, exclusions, products, services, and programs.

SafeButler Inc. strives to ensure that the information on this site is up to date, but we will not be held

liable for any delays, inaccuracies, errors, or omissions. This site and all materials contained on it are

distributed and provided "as is" and "as available" for use. SafeButler.com makes no representations or

warranties of any kind, express or implied, as to the operation of this site or to the information, content,

materials, or products included on this site. You expressly agree that your use of this site is at your sole

risk.